2024 Capital Credit Retirement

Members - check your April bill for your capital credit retirement! Central Electric Cooperative's (CEC's) Board of Directors voted to retire $1.9 million in 2024. Capital credits are one of the most significant benefits of being a co-op member and we hope it serves you well.

Below are answers to some of CEC's most frequently asked capital credit questions.

What are Capital Credits?

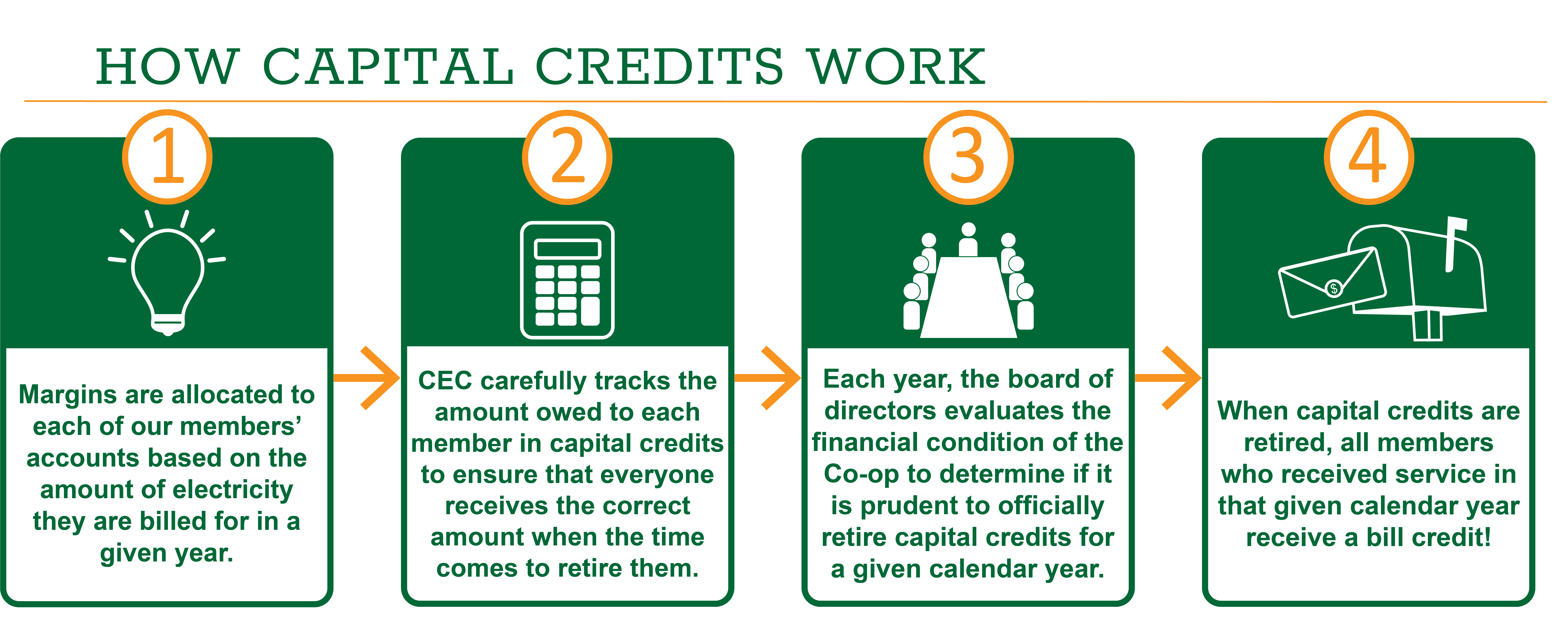

Capital credits are a return of members’ equity or ownership in the cooperative that has accumulated over a period of time.

How does CEC decide how much capital credit money a member gets back each year?

A few factors determine how much capital credit money the co-op can retire. CEC must have enough cash on hand to cover operating costs to provide reliable service and pay expenses. Additionally, the co-op must maintain a good equity ratio. Retiring capital credits reduces CEC’s equity ratio, so this must remain in good standing after paying members.

Once CEC’s finance and accounting department determines how to keep the cooperative within a healthy equity ratio, the board of directors is presented with four options for approval. The board prefers an option that gives something back to everyone, whether the member has been with CEC for one year or 25 years.

Why don’t members just get all of their money back from the previous year? Why are retirements spread out?

CEC operates on a 15-20 year capital credit rotation. The goal of the rotation is to maintain healthy business operations and equity levels.

How much is CEC retiring in 2024?

The co-op is retiring $1.9 million in 2024. Members will see this appear as a bill credit on their April bill.

Why did my neighbor receive a check and I didn’t?

Members who have an active account with CEC will receive their capital credits via a bill credit on their April electric bill. If someone has moved or is no longer a member, they will still receive their capital credit allocation. However, since they no longer have an account, a check is issued to them instead.

What does CEC do with unclaimed capital credits?

CEC seeks out former members who are due capital credits, even if they are no longer a member. If the member does not claim them and the capital credits remain unclaimed for three or more years, they are transferred to a fund for charitable and educational purposes. Scholarships, the Youth Tour program and various community donations are just a few examples of what unclaimed capital credits are used for.

Because capital credits may not be retired for several years, it is important that you keep the cooperative informed of your current address. If you move and are no longer a member, be sure to update your contact information so we can send you a capital credits check.